Interpretation & ESG disclosure context

Not all disclosure risk arises at the same point.

Some risks appear when disclosures are drafted. Others emerge later — when standards are interpreted, language is revisited, or statements are read in a different context.

The pages below address recurring areas where organisations commonly misjudge scope, relevance, or wording, even when intentions are reasonable and work is underway.

They are not our primary services, though we assist our clients on these tasks when it is necessary. They are contextual guidance on how disclosure language behaves once published.

Why ESG Disclosure Context topics matter

Across ESG and climate disclosures, problems rarely arise because work was not done.

They arise because:

-

standards were interpreted too broadly or too narrowly

-

uncertainty was smoothed out in public language

-

governance or materiality claims were stronger than evidence

-

internal analysis was mistaken for disclosure obligation

These issues are often invisible at publication and surface later — during audit review, board discussion, or external scrutiny.

Common areas of disclosure interpretation risk

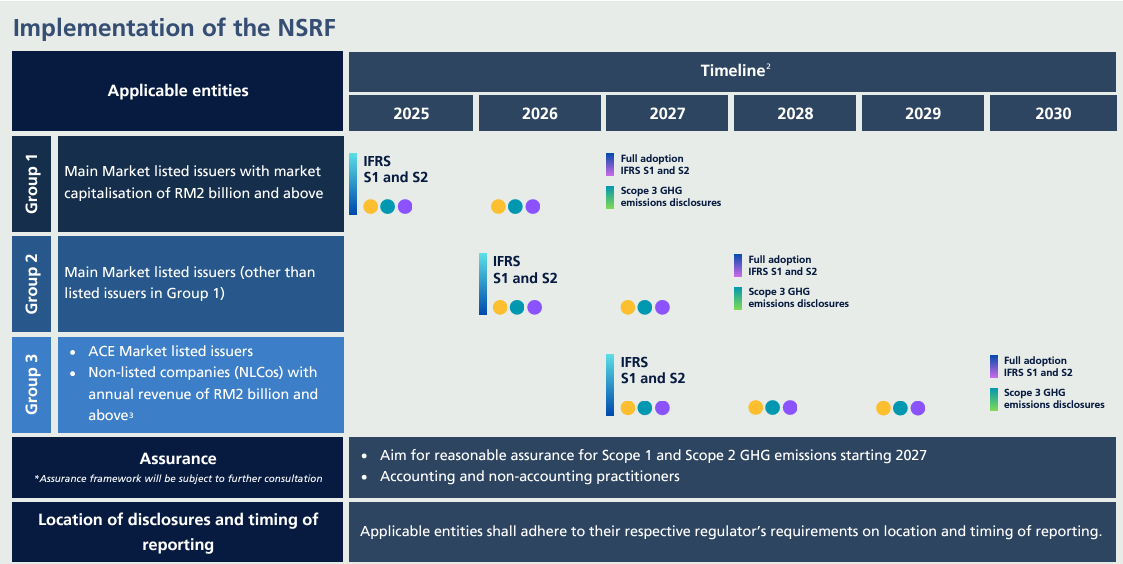

IFRS S1 & S2 — relevance and scope

How sustainability and climate standards are interpreted in context, and how decisions are made about what applies, what can be excluded, and what should be disclosed safely.

ESG / Climate risk & resilience

How climate risk, resilience, and scenario-related language is framed so that uncertainty remains visible and disclosures do not imply commitments that were never made.

Governance claims & materiality

How statements about governance, oversight, and material topics are interpreted once published, and where claims often extend beyond what can later be demonstrated.

How this connects to our services

These topics are commonly encountered before or during disclosure drafting, but they are usually resolved through judgment and boundary-setting, not implementation.

Where interpretation issues create disclosure risk, they are typically addressed through pre-publication disclosure review or disclosure defensibility work, before statements are finalised or repeated.

This page exists to clarify where risk tends to arise, not to replace that work.

Disclosure risk is rarely caused by lack of effort.

It is caused by how decisions and language are later interpreted.