SIRIM ESG Verification – A New Standard for Trust in ESG Reporting

- 24/06/2025

- Posted by: Ildar Usmanov

- Categories: Compliance, ESG Reports, Regulations

What is SIRIM ESG Verification?

Malaysia’s ESG landscape is moving rapidly toward credibility and accountability. The release of SIRIM 56:2024 introduces a national standard for ESG reporting. It sets out principles for reporting, guidance on materiality, requirements for indicators, and expectations for verification. With this, organisations now have a structured way to demonstrate that their disclosures are accurate and trustworthy.

SIRIM QAS has already launched ESG verification services aligned with the standard. This means companies can now prepare ESG reports that meet recognised benchmarks and are independently verified. In this article, we explain how SIRIM ESG Verification works, how it connects with other reporting frameworks, and what companies must do to build audit-ready ESG disclosures.

Why ESG Reporting and SIRIM ESG Verification Matters

The demand for reliable ESG reporting is intensifying. Investors, regulators, and customers expect companies to show not only good intentions but also credible performance data. Weak disclosures can undermine confidence, trigger accusations of greenwashing, and even limit access to finance.

Verified reporting changes this dynamic. By aligning with SIRIM ESG Verification, companies can ensure that their sustainability disclosures are supported by evidence and tested against an independent standard. This strengthens trust with banks and investors, reassures customers in global supply chains, and demonstrates readiness for regulatory oversight.

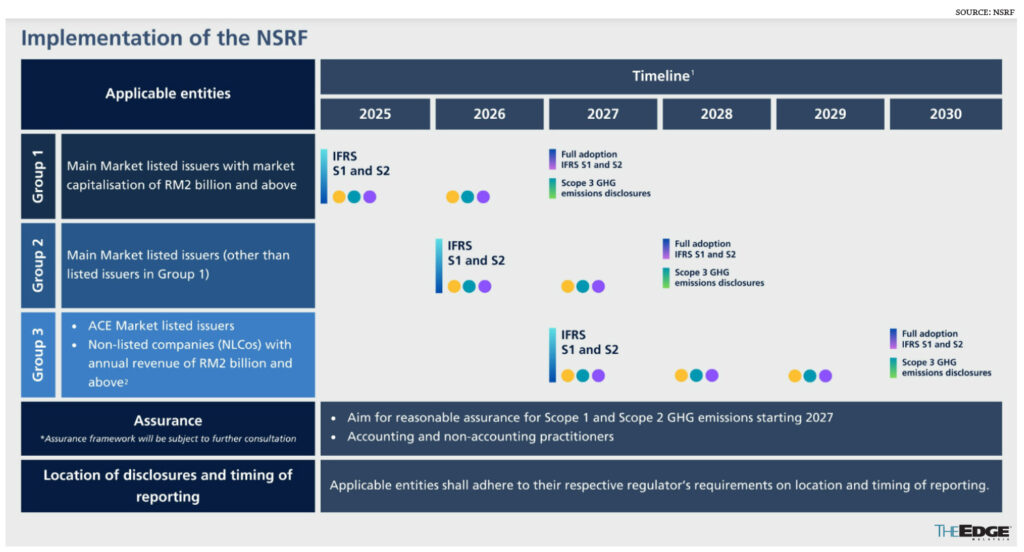

In Malaysia, the shift is clear. Bursa Malaysia has already announced phased adoption of IFRS S1 and S2 standards, starting with large public listed companies. At the same time, the government’s i-ESG Framework calls for stronger adoption from 2027 onwards. Against this backdrop, a verified ESG report is no longer an optional extra—it is becoming a marker of credibility and competitiveness.

Regulatory Landscape: Malaysia and Global

The Malaysian ESG framework is taking shape in layers. SIRIM 56:2024, formally titled “Environmental, Social and Governance (ESG) – Reporting”, defines how organisations should present ESG data. It includes specific requirements on disclosure, guidance on materiality, and—importantly—an entire section on the verification of ESG reports. This means that reports aligned with SIRIM 56 are not just narratives; they are intended to withstand audit-level checks.

Verification services are already available. SIRIM QAS International provides ESG verification to companies that wish to have their reports evaluated against the SIRIM 56 framework. At present, the standard is voluntary, though its relevance is growing as regulators and investors increase pressure for credible reporting.

Globally, SIRIM 56 complements existing standards. The GRI Standards remain the most widely used for sustainability disclosures. IFRS S1 and S2, issued by the ISSB, focus on financially material ESG and climate information. SASB Standards deliver sector-specific metrics, while frameworks such as TCFD and initiatives like the SBTi shape climate risk and decarbonisation disclosures.

For Malaysian companies, SIRIM ESG Verification acts as the national bridge. It aligns local reporting with global benchmarks, gives structure to ESG disclosures, and ensures that reports are backed by independent validation.

Key Challenges Companies Face during SIRIM ESG Verification

Preparing a report that meets SIRIM 56 ESG Verification requirements is not straightforward. Many companies struggle with incomplete or unreliable ESG data, making it difficult to prove progress. Others find themselves caught between multiple frameworks—Bursa Malaysia’s requirements, GRI, IFRS, SASB, and now SIRIM 56.

Another challenge lies in expertise. Few organisations have trained staff who understand both reporting frameworks and verification expectations. Verification itself requires traceability: every metric must be supported with evidence, controls, and documentation. Without this, even well-intentioned disclosures may fail an external review.

Finally, verification carries costs and resource demands. Smaller firms may find the process daunting, while larger companies may struggle with data integration across subsidiaries. Without early preparation, organisations risk delays, rework, or reports that cannot withstand independent scrutiny.

How to Approach IRIM ESG Verification

To succeed with SIRIM ESG Verification, companies need a structured methodology. The process begins with scoping: defining the boundaries of the organisation and its reporting obligations. From there, materiality assessments help identify which ESG topics are most relevant to the business and its stakeholders.

Once material topics are defined, companies must select indicators and gather data. SIRIM 56 provides guidance on ESG indicators, which include environmental, social, and governance metrics. This step demands rigour—data sources, assumptions, and controls must all be documented so that they can withstand external review.

The drafting stage follows. Reports should combine narrative and quantitative data, ensuring clarity, comparability, and alignment with recognised frameworks. Annex B of the standard even outlines a suggested content structure, helping organisations present their disclosures systematically.

Preparation for verification is the final but most critical stage. Companies must map each reported metric to supporting evidence, run internal reviews, and, where possible, conduct mock verifications. Only then should they submit the report for independent verification by SIRIM QAS or another accredited provider. The cycle ends with publication and a review of lessons learned, setting the foundation for continuous improvement in future reports.

Best Practices and Tips

Based on early experience, several practices stand out. Companies that succeed with SIRIM ESG Verification usually start early, allowing months rather than weeks to prepare. They map SIRIM 56 requirements to established frameworks such as GRI or IFRS, reducing duplication and confusion.

Documentation is another key. Every figure, assumption, and narrative should be backed by traceable records. Stakeholder engagement must also be genuine, not tokenistic, to ensure materiality reflects real concerns.

Internal reviews, including mock verifications, catch weaknesses before the official audit. And finally, organisations that treat ESG reporting as a continuous cycle—learning and improving each year—move steadily toward stronger, more credible disclosures.

Future Trends

The future of ESG reporting points toward more assurance, more integration, and more pressure for accountability. As IFRS S1 and S2 gain global traction, Malaysian companies will increasingly need reports that can serve both domestic and international stakeholders.

Technology will accelerate this shift. Automation, AI, and ESG data platforms will make it easier to collect, validate, and analyse sustainability metrics. Verification itself will likely become a standard expectation, particularly for PLCs and companies in export-driven sectors.

At the same time, financing and regulation will increasingly depend on verified data. Access to green bonds, sustainability-linked loans, and government incentives may hinge on having a report aligned with SIRIM ESG Verification. Companies that adopt early will avoid compliance shocks and gain reputational advantage.

How SuSciCo Helps You Survive

At SuSciCo, we understand that companies rarely struggle because of poor effort. They struggle because every buyer, auditor, and investor uses a different system to judge their ESG rating. Our role is to simplify this complexity and prepare you to respond with confidence.

We do not issue certifications or ratings—that responsibility lies with accredited auditors and rating agencies. What we do is ensure you are ready. Your evidence is structured, your gaps are closed, and your disclosures are aligned with the expectations of each system.

Here is how we support you:

- Unified evidence preparation → We help you build a core set of policies, procedures, and records that can be adapted across multiple ESG rating systems, including EcoVadis, SMETA, and BSCI.

- Audit readiness support → Through gap analyses, mock audits, and corrective action planning, we prepare you for third-party inspections such as SMETA, BSCI, or SA8000.

- EcoVadis score improvement → We guide you in strengthening documentation, aligning with EcoVadis methodology, and closing evidence gaps to improve your ESG rating over time.

- Disclosure alignment for investors → We connect your sustainability reporting with frameworks used by FTSE4Good, MSCI, and S&P Global. This ensures your ESG rating reflects your strengths in the eyes of investors and capital markets.

Don’t waste resources on trial and error. Partner with a team that has guided Malaysian SMEs through EcoVadis, supplier audits, and SIRIM preparation—and get ready for the ESG ratings that matter most to your business.

Producing ESG reports that stand up to scrutiny takes planning, structure, and independent assurance. At SuSciCo, we help organisations navigate SIRIM 56 from start to finish: identifying material topics, building reporting systems, and preparing for verification.

👉 Build an audit-ready ESG report today. Explore our SIRIM 56 Service and let us guide you through ESG verification with confidence. Request a Quote.

SuSciCo helps in implementing Sustainability Practices

At SuSciCo, we help companies implement a Customer-Centric Sustainability approach by integrating ESG principles into their strategies. Our services include GHG management, sustainability reporting (GRI, IFRS, Bursa Malaysia), supply chain optimization, and ISO 14001 EMS development. We offer PCF and LCA assessments, sustainable procurement strategies, and waste management solutions to align products and operations with customer expectations. Through tailored ESG training and stakeholder engagement, we empower businesses to reduce environmental impacts, foster innovation, and build trust for sustainable growth.