NSRF – No Waste and Emissions Disclosures? What about IFRS S1 and S2?

- 14/01/2025

- Posted by: Ildar Usmanov

- Categories: Bursa, Compliance, Regulations

On 23rd December 2024, Bursa Malaysia introduced Amendments in Relation to Sustainability Reporting Requirements and Other Enhancements. These changes eliminate the obligation for listed issuers to disclose waste and emissions management as part of the Common Sustainability Matters. This shift aligns Bursa Malaysia’s sustainability reporting framework with international standards and the National Sustainability Reporting Framework (NSRF).

While the updates reduce mandatory disclosures, ESG managers should not abandon waste and emissions data collection. Global standards and stakeholder expectations are evolving rapidly, and restarting data collection later can be challenging. For instance, IFRS S1 and S2, forming part of the NSRF roadmap, mandate comprehensive disclosure requirements and are already applicable to Public Listed Companies (PLCs) and large non-listed companies in Malaysia.

National Sustainability Reporting Framework (NSRF)

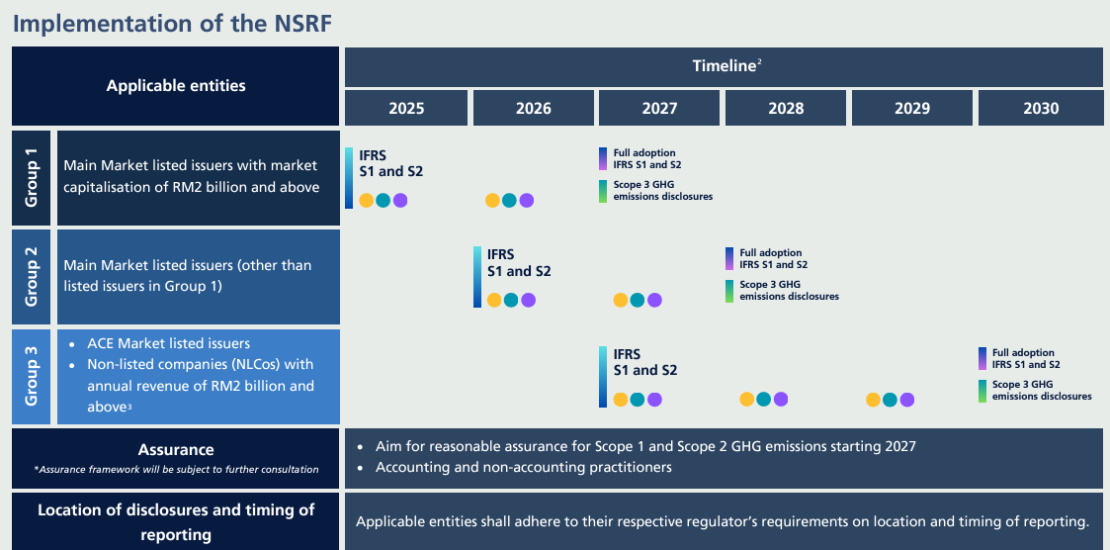

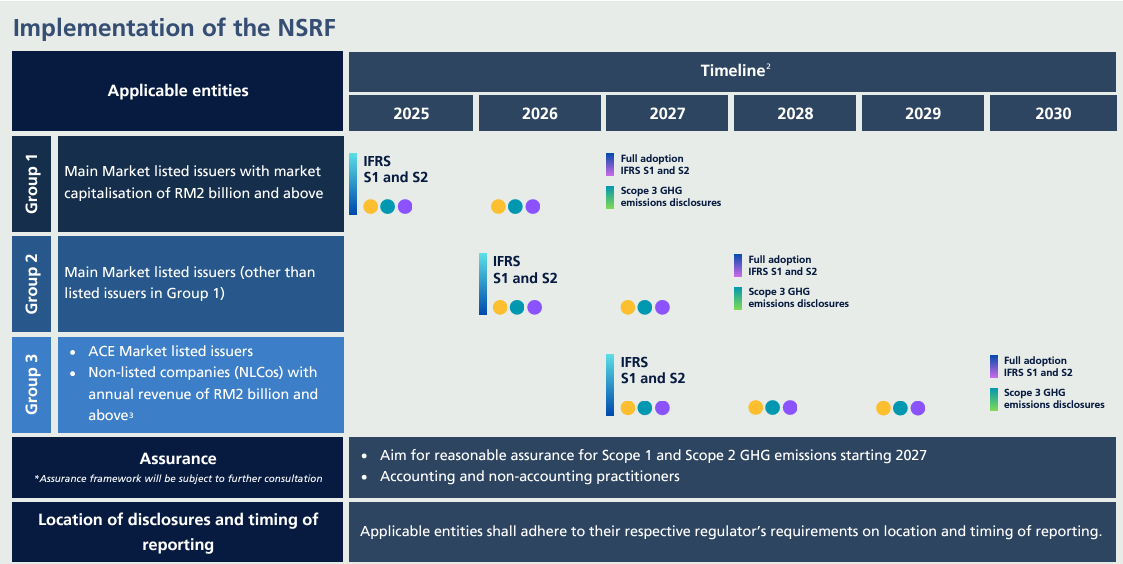

In September 2024, Malaysia’s Advisory Committee on Sustainability Reporting (ACSR), supported by the Ministry of Finance, launched the National Sustainability Reporting Framework (NSRF). This framework mandates that Malaysian companies adopt the IFRS Sustainability Disclosure Standards—specifically, IFRS S1 and IFRS S2—as the baseline for sustainability reporting. The implementation will be phased:

- Group 1: Main Market listed issuers with a market capitalization of RM2 billion and above are required to adopt IFRS S1 and S2 for annual reports issued for periods beginning on or after 1 January 2025.

- Group 2: Remaining Main Market listed issuers are required to adopt IFRS S1 and S2 for annual reports issued for periods beginning on or after 1 January 2026.

- Group 3: ACE Market listed issuers and non-listed companies with annual revenue of RM2 billion and above are required to adopt IFRS S1 and S2 for annual reports issued for periods beginning on or after 1 January 2027.

This strategic move aims to enhance the consistency, reliability, and comparability of sustainability information disclosed by Malaysian companies, aligning with global standards and bolstering the nation’s appeal to international investors.

IFRS S2: GHG Emissions Disclosure Requirements

The IFRS S2 Climate-related Disclosures Standard demands detailed reporting of greenhouse gas (GHG) emissions. It categorizes emissions into:

- Scope 1: Direct emissions from sources owned or controlled by the company.

- Scope 2: Indirect emissions from the generation of purchased electricity, heating, and cooling.

- Scope 3: All other indirect emissions in the value chain, such as those from suppliers and end-users.

Entities must measure emissions following the Greenhouse Gas Protocol, unless another method is legally required. Additional disclosures include:

- Climate-related targets and progress against them.

- Performance metrics tied to climate initiatives.

- Planned use of carbon credits, detailing certification schemes and credit types.

IFRS S1: Materiality-Driven Sustainability Reporting

The IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information emphasizes a principles-based approach to sustainability reporting. It focuses on:

- Governance of sustainability-related risks and opportunities.

- Strategy to address these risks and opportunities.

- Risk management processes for identifying and responding to sustainability challenges.

- Metrics and targets used to monitor progress.

Although waste management is no longer a mandatory disclosure under Bursa Malaysia’s framework, IFRS S1 requires companies to assess material sustainability risks that could affect their financial prospects. If waste management is significant to a company’s operations, it should still feature in their sustainability disclosures. Companies should also refer to industry-based SASB Standards for identifying relevant metrics, which may include waste-related data for certain sectors.

Key Takeaways for ESG Managers

- GHG Emissions: Explicitly required under IFRS S2, including Scope 1, 2, and 3 emissions.

- Waste Management: No longer mandatory under Bursa Malaysia guidelines, but materiality under IFRS S1 could necessitate disclosure.

- Global Alignment: The NSRF roadmap emphasizes adopting international standards like IFRS S1 and S2, reflecting a broader shift in sustainability reporting expectations.

As sustainability reporting evolves, staying proactive is crucial. Ensure your organization is future-ready by continuing data collection for waste and emissions, even if not immediately required. Need help navigating the complexities of IFRS S1, IFRS S2, or Bursa Malaysia’s updates? Contact us to streamline your sustainability strategy and reporting processes.

At SuSciCo, we help companies implement a Customer-Centric Sustainability approach by integrating ESG principles into their strategies. Our services include GHG management, sustainability reporting (GRI, IFRS, Bursa Malaysia), supply chain optimization, and ISO 14001 EMS development. We offer PCF and LCA assessments, sustainable procurement strategies, and waste management solutions to align products and operations with customer expectations. Through tailored ESG training and stakeholder engagement, we empower businesses to reduce environmental impacts, foster innovation, and build trust for sustainable growth.