Sustainability Practices in Malaysia for SMEs: Insights from Alliance Bank’s ESG Report

- 23/01/2025

- Posted by: Ildar Usmanov

- Category: Uncategorized

Sustainability practices in Malaysia for SMEs are gaining significant momentum. The latest report, “The Path to Sustainable Impact – Sectoral Insights of Malaysian SMEs“, commissioned by Alliance Bank Malaysia Berhad, offers a detailed overview of Environmental, Social, and Governance (ESG) practices among Malaysian SMEs. This second edition builds upon earlier findings and provides practical strategies to guide SMEs on their sustainability journey. Let’s explore the key insights.

Rising ESG Awareness and Adoption

Sustainability practices in Malaysia for SMEs are advancing rapidly, with awareness increasing nearly sixfold since the first ESG report. Previously, only 14% of SMEs were familiar with ESG principles. Today, that number stands at 80%. Similarly, ESG adoption has doubled, with 60% of SMEs implementing sustainability practices compared to 28% previously.

This growth has been fueled by government initiatives, corporate influence, and NGO efforts to promote sustainable business models. SMEs are beginning to view sustainability practices as integral to their operations.

Sectoral Differences in Sustainability Practices

The report highlights how sustainability practices in Malaysia for SMEs vary across industries:

- Manufacturing leads both in ESG awareness and adoption, driven by global market pressures and regulatory compliance.

- Services show strong growth in ESG awareness but lag in implementation.

- Construction and agriculture sectors are progressing but still trail behind manufacturing in adoption rates.

These sectoral differences emphasize the need for tailored strategies to encourage ESG adoption across diverse industries.

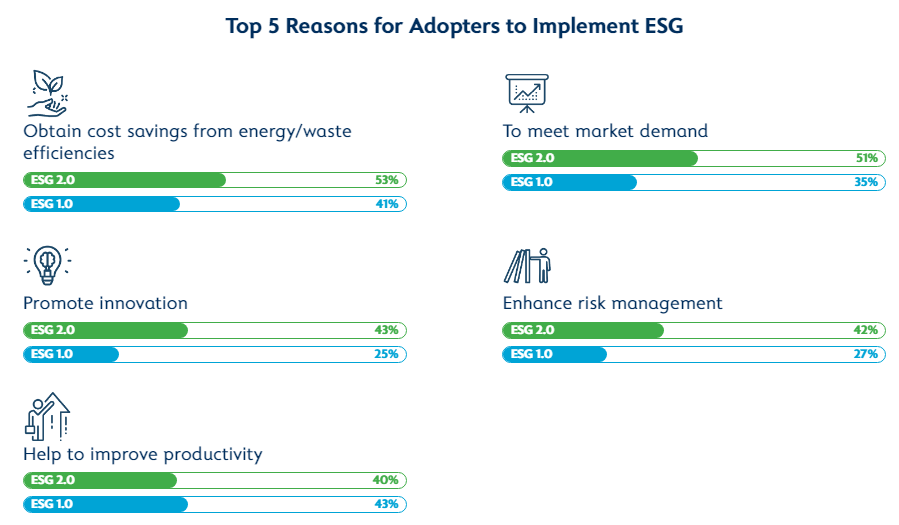

Motivations Behind ESG Implementation

Cost savings and meeting market demands are the primary drivers for SMEs adopting sustainability practices in Malaysia. Additionally, innovation is emerging as a key motivator, enabling businesses to achieve profitability and growth while aligning with ESG goals. Non-ESG adopters are also recognizing the importance of cost savings and market opportunities, signaling potential for increased adoption.

Source: alliancebank.com.my

Challenges in Implementing Sustainability Practices

Despite progress, SMEs face notable challenges in adopting sustainability practices in Malaysia. Key obstacles include:

- Information overload: Many SMEs struggle to navigate the abundance of ESG guidelines and frameworks.

- Resource constraints: Limited budgets and manpower hinder effective implementation.

- Lack of sector-specific guidance: SMEs need clear, concise, and tailored ESG guidelines to address unique industry challenges.

Addressing these issues is essential to maintaining the upward trajectory of ESG adoption.

Despite progress, SMEs face notable challenges in adopting sustainability practices in Malaysia. Key obstacles include:

- Information overload: Many SMEs struggle to navigate the abundance of ESG guidelines and frameworks.

- Resource constraints: Limited budgets and manpower hinder effective implementation.

- Lack of sector-specific guidance: SMEs need clear, concise, and tailored ESG guidelines to address unique industry challenges.

Addressing these issues is essential to maintaining the upward trajectory of ESG adoption.

Support Needed to Advance Sustainability Practices

To overcome these barriers, SMEs emphasize the importance of supportive measures, such as:

- Tax incentives: 67% of SMEs consider tax incentives critical for investing in sustainable technologies.

- Government grants: 59% of SMEs identify grants as vital for financing their ESG initiatives.

- Official guidelines: Clear, sector-specific ESG guidelines are essential to help SMEs navigate their sustainability journey.

These supports will empower SMEs to embed sustainability practices into their business models more effectively.

To overcome these barriers, SMEs emphasize the importance of supportive measures, such as:

- Tax incentives: 67% of SMEs consider tax incentives critical for investing in sustainable technologies.

- Government grants: 59% of SMEs identify grants as vital for financing their ESG initiatives.

- Official guidelines: Clear, sector-specific ESG guidelines are essential to help SMEs navigate their sustainability journey.

These supports will empower SMEs to embed sustainability practices into their business models more effectively.

Financial Benefits of Sustainability Practices

SMEs that have adopted ESG practices in Malaysia report significant financial gains:

- 38% achieved more than a 51% revenue uplift.

- 24% recorded over a 51% cost savings.

These benefits demonstrate that sustainability practices are not only environmentally beneficial but also financially rewarding.

Role of Government and Regulatory Bodies

The Malaysian government plays a pivotal role in promoting sustainability practices for SMEs. Key initiatives include:

- NIMP 2030 and the i-ESG Framework, which provide guidelines for ESG adoption.

- The Simplified ESG Disclosure Guide (SEDG), designed specifically for SMEs.

- Bursa Malaysia’s ESG Reporting Platform, which supports mandatory ESG reporting for listed companies.

These frameworks aim to simplify ESG reporting and encourage broader adoption.

The Malaysian government plays a pivotal role in promoting ESG practices for SMEs. Key initiatives include:

- NIMP 2030 and the i-ESG Framework, which provide guidelines for ESG adoption.

- The Simplified ESG Disclosure Guide (SEDG), designed specifically for SMEs.

- Bursa Malaysia’s ESG Reporting Platform, which supports mandatory ESG reporting for listed companies.

These frameworks aim to simplify ESG reporting and encourage broader adoption.

Recommendations for Enhancing Sustainability Practices

The report provides actionable recommendations to strengthen ESG practices in Malaysia for SMEs:

- Conduct targeted workshops and online courses, particularly for the services and agriculture sectors.

- Develop clear, sector-specific ESG guidelines to reduce confusion and improve efficiency.

- Provide financial incentives and grants, especially for high-consumption sectors.

- Integrate advanced technologies to boost agricultural productivity and sustainability.

These recommendations aim to simplify the ESG journey for SMEs and ensure sustainable growth.

SuSciCo helps SMEs in implementing Sustainability Practices

At SuSciCo, we help companies implement a Customer-Centric Sustainability approach by integrating ESG principles into their strategies. Our services include GHG management, sustainability reporting (GRI, IFRS, Bursa Malaysia), supply chain optimization, and ISO 14001 EMS development. We offer PCF and LCA assessments, sustainable procurement strategies, and waste management solutions to align products and operations with customer expectations. Through tailored ESG training and stakeholder engagement, we empower businesses to reduce environmental impacts, foster innovation, and build trust for sustainable growth.